-

Business Startup

-

Company Registrations

Firm Registration

Special Entities

-

-

Search Items

-

Company Search

IFSC Code Search

GST Registration Search

Pin Code Search

-

-

Business Management

-

Funding

Intellectual Property

-

-

GST

Starts from 1500/- only

GST Registration

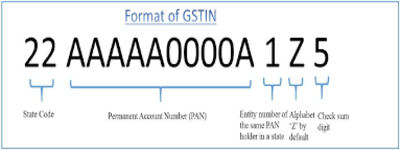

Any person with a taxable supply turnover over Rs.20 lakhs would be required to register for GST in India(means in Your State like GST Registration in delhi). There is also a mechanism available for voluntary GST registration to help claim input tax credit. The term person under GST law includes Proprietorship, Partnership firms, Hindu Undivided Family, Company, LLP, Society and any other legal entity. Registration in GST must be obtained within 30 days of exceeding the Rs.20 lakh turnover limit. In case of those having existing service tax or VAT registration, procedure would be announced for migrating the VAT or Service Tax registration as a GST registration.It is expected that registration of GST would be provided based on PAN. Another major advantages of GST implementation(GST Registration Process) is that the same registered GST number can be used in all states across India. Under the current VAT regimen governed by the State Governments, a VAT dealer must obtain VAT registration in each of the State, incuding additional cost and compliance formalities.

Document Required For GST Registration in Delhi

Our Financial Advisor is Leading online Coporate Portal!! to Provide all kinds of qeries related GST Registration in delhi

Contact

Pricing and Packages

Start Your GST Registration in Delhi with Us

Choose best suited entity for your business and get your GST Registration in Delhi with the Us.

Silver Package

Rs.1500/-only

GST registration entities with existing VAT or service tax registration. Inclusive of government fee.

Gold Package

Rs.3200/-only

New GST registration for entities that do not have VAT or service tax registration. Inclusive of government fee

Diamond Package

Rs.5000/-only

MSME registration and GST registration for entities that do not have VAT or service tax registration. Inclusive government fee.